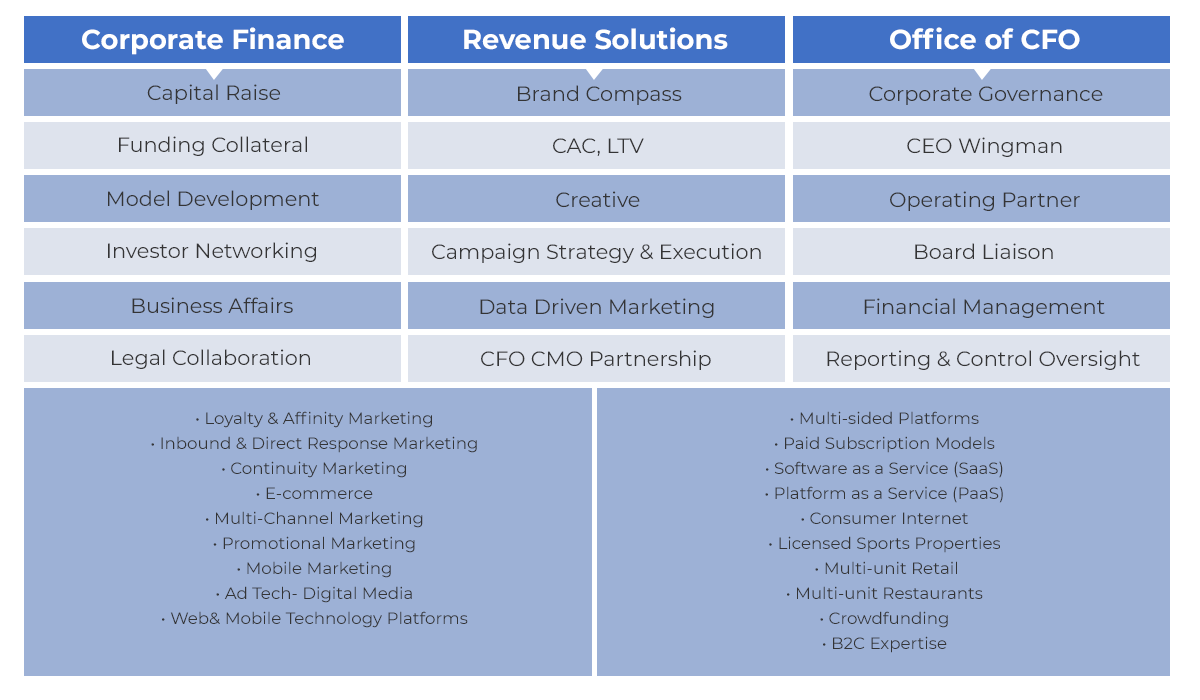

An Integrated Solutions Platform Corporate Finance, Marketing, C-suite Support

Kingside Partners helps business owners build their business.

Kingside C-suite Solutions

We help business owners build revenues, profit and the value of their business. Kingside delivers what matters most – hands-on involvement, C-suite expertise, technical knowledge and leadership skills. Our clients have the trust and confidence that we understand their needs, have the ability to identify situations and solve problems from decades of real experience. Kingside brings a network of resources, contacts and professionals to get the job done.

Performance Advisory Services:

• Deliver Hands-on C-suite Rev & EBITDA Focus

• Operations & Financial Management Oversight

• Corporate Governance & Board Liaison

• Quality Of Business Assessment

• Ten Point Performance Action Plan Methodology

• CEO Wingman

• Outsourced COO

Building Revenues:

• Outsourced CMO

• Full Agency Capabilities

• Strategy Alignment with multi-channel execution

• Build Data Asset for Data Driven lead generation

• Business Intelligence reports and analysis

Hands-on Transaction Assistance:

• Debt & Equity Fundraising Road Map – Wingman

• Professional “presence” throughout transaction

• Capital Raise Quality Teaser, CIM, Pitch deck, Models

• Acquisition diligence and post closing integration

• Deal structure – Term Sheet and Valuation Scenarios

• Resolve Deal Issues & Closing Documents

About Nick Mammola, Managing Director

Founder of Kingside Partners LLC. Prior to founding Kingside Partners in 2001, Nick served as board member and C-suite executive in large public and middle market companies. Nick served as the COO, CFO and board member of CYRK, Inc. (NASDAQ:CYRK) and helped grow the company to one of the largest loyalty and promotional marketing companies in the world. Nick led multiple public equity and debt public offerings and the take private strategic alternative with billionaire Ron Burkle and the Yucaipa Companies, LLC Previously, Nick held several C-suite roles at Papa Gino’s, Inc. as part of the team that grew the company to 200+ locations and led the sale to a private equity group led by Berkshire Partners, McCown Deleeuw and Greenleaf Ventures.

In 2004, Nick co-founded Stoneacre Partners, LLC which acquired the exclusive worldwide rights to design, develop and build NASCAR’s loyalty and affinity programs and industry fan database. The venture was backed by Bain Capital Ventures, Halyard Capital and top tier HNW investors and family offices. Nick led the exit event to a strategic acquirer in 2012.

Through Kingside, Nick holds equity interests in Tentacle, Brand Compass, Tentacle Capital and Stoneacre 2.0.

Why Kingside

Nick brings his hand-on direct involvement and his team of resources across the disciplines of finance, marketing, technology and consulting. Kingside serves as a cost effective, proven, results driven addition to your success team. Sophisticated experience honed from decades of real world, big company, high growth situations. We work with clients at various stages in their life cycle. From inception to scale to exit. We help build enterprise value.

We know that it is rarely a straight and smooth ride. We help clients get back on track when dealing with the unexpected or underperformance. We have extremely deep and specialized experience in consumer centric and marketing centric businesses as well as B2C multi-unit business models and subscription membership businesses.

When Kingside

• Whether the need is finance and business building acumen in funding efforts

• Whether the need is experienced hands-on leadership

• Management know-how in addressing operating factors dragging company performance

• Whether the need is for help in consummating complex corporate transactions, Nick’s career breadth & depth allows Kingside to be an effective, proven hands-on business addition to your success team.

Ownership Interests

Case Studies

The Company is a rapidly growing franchisor of IV administered, medically operated, “cellular healthcare” clinics expanding nationally. Nick served as a corporate finance and business affairs advisor. Nick collaborated with the CEO in pursuit of the Company’s initial funding round and advised on the funding strategy, the presentation of the proforma historical operating results and the development of the investor model, the teaser and other marketing collateral, the investor networking and helped engage in the negotiations with targeted investors.

The Company became challenged as a result of material changes in third party insurance reimbursement policies. Nick served as an Outsourced Operating Partner reporting directly to the Company’s board and equity sponsors. Nick was asked to provide oversight and hands-on coaching to the Company’s first time CEO and Controller. Nick helped guide the company through its liquidity challenges as it sought to stabilize the core business and secured new funding through complementary acquisitions. Nick and his team helped create the business plan using key financial and marketing data, and by integrating the key components of data analytics, financial management, marketing strategies and unit operations. Nick spearheaded the design and development of cohort reports that yielded critical insights on missed revenue and profit opportunities that allowed leadership to action EBITDA positively. Nick supported the equity sponsors in the pursuit of acquisitions and third party capital financing.

Client is a private equity backed substance abuse recovery center which had been severely underperforming post-acquisition thereby requiring ongoing follow-on capital infusions from the company’s backers. Nick was retained to perform an initial assessment of the company’s situation, operating results and organizational dynamics. The assessment through direct interaction and consultation with key company personnel identified several pre & post-acquisition mis-steps and decisions that served to lead to organizational C-suite dysfunction, team disharmony and underperformance. The assessment also identified weaknesses and deficiencies in corporate governance practices, financial management & reporting practices. Nick led the subsequent development and implementation of a ten (10) point stabilization and organizational change initiative.

Nick served as a corporate finance and business affairs advisor to a start-up entrepreneur that had developed environmental technology consisting of proprietary eco-friendly air, water & soil purification solutions. Nick supported the founder’s Series A fund raising effort in the development of the company’s offering memorandum, investor materials, valuation methodology, investment security instruments and participated in investor discussions. Tentacle created the client’s brand identity, designed & built its corporate website, supported the ensuing go-to market launch strategy.